FOX – WOFL

More than ⅓ of Millennials still live with their parents.

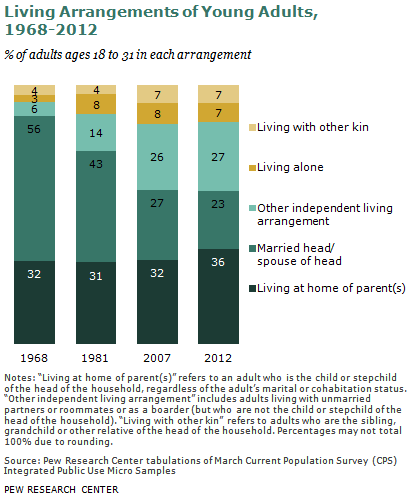

The new Pew Study documents the steady rise of young adults returning home to mom and dad, or in some cases not moving out in the first place! In 2012, a record 21.6 million adults (up from 18.5 million in 2007) in the Millennial generation, also known as Generation Y, still live in or have moved back into their parents’ homes.

Age & Gender Makes a Difference!

Overall 36% of the nation’s young adults ages 18 to 31 still live with Mom & Dad, but within that group the percentages of those still at home varies greatly.The Pew Research indicates that the younger crowd, ages 18 to 24, make up 56% percent of those still at home, while only 16% of the older children, ages 25 to 31, still reside at home with mom and dad. The remaining 28% consists of “children” who’s age is outside the scope of this study.

Overall 36% of the nation’s young adults ages 18 to 31 still live with Mom & Dad, but within that group the percentages of those still at home varies greatly.The Pew Research indicates that the younger crowd, ages 18 to 24, make up 56% percent of those still at home, while only 16% of the older children, ages 25 to 31, still reside at home with mom and dad. The remaining 28% consists of “children” who’s age is outside the scope of this study.

In addition to a difference in age, there is also a notable difference between males and females. Men of the Millennial generation (40%), when compared to women (32%), are more likely to be living with their parents, continuing a long-term gender gap in the share of young adults who do so.

So Why The Increase In Cohabitation?

Acording to the Pew Research study:

The steady rise in the share of young adults who live in their parents’ home appears to be driven by a combination of economic, educational and cultural factors. Among them:

|

Is This Trend Welcomed By Parents?

When it comes down to it, parents’ are concerned about their children’s financial situation, and see allowing their child to move back home to be a way to help them. Their concern does have merit, as most Millennials are already loaded with debt.

A Wells Fargo survey found that more than half of Millennials say that debt is their biggest financial concern, and acording to a recent Forbes article, this shouldn’t come as a big suprise since Millennials love to spend money they don’t have.

Millennial college students, those without a full time job, spend $784 a month on discretionary expenses, especially food and entertainment, according to Mooslyvania marketing agency. Millennials are the largest demographic purchasing new technological gadgets and fashion apparel, seeking instant gratification. And then there is the fact that some Millennials aren’t even footing the bills. Some 59% of moms pay for their Millennial child’s cell phone and more than half of moms spend $5,000 per year on each adult child to cover everyday expenses, according to Vibrant Nation.

A quote by Steve Jobs, the inventor, marketer, and one of the co-founders of Apple Inc. may sum it up best:

|

“Millennial lifestyles and spending habits

|

In addition to the aforementioned credit debt, there’s student debt.

On average, the class of 2013 graduated with a debt burden of $35,200. This debt is causing young people to delay pursuing many of life’s milestones. A new study from the American Institute of CPAs shows student loan borrowers have delayed saving for retirement, put off buying a car, postponed buying a house, and have even put marriage on hold.

Gen-Y, Like Gen-X, May Never Be Able To Retire.

Although some Millennials are provisioning for their retirement, 50% say they have yet to start, but they plan to do so at the age of 30. The Wells Fargo survey says the Millennials don’t have enough money to start saving and prefer to pay down debt first. It is great to pay down debt, but we would suggest to this age group to try and do both at the same time. Save while paying down debt. The earlier you save for retirement, the better overall.

Although some Millennials are provisioning for their retirement, 50% say they have yet to start, but they plan to do so at the age of 30. The Wells Fargo survey says the Millennials don’t have enough money to start saving and prefer to pay down debt first. It is great to pay down debt, but we would suggest to this age group to try and do both at the same time. Save while paying down debt. The earlier you save for retirement, the better overall.

If your employer offers a retirement plan, use it! Millennials have always gravitated to offerings that were free or cheap (think: Napster and iTunes), and since many employers offer retirement contribution matching, use it! This is free money!

It’s hard to start thinking about saving for retirement in your 20s, but if you do, you will be better off in the long run. To help get you started, you can use this calculator to help you figure out what you need to save to retire comfortably.

[calc id=1980]

There Is Still Hope!

The good news is that there is still time, but don’t wait, start today by planning a budget to get out of debt and start planning for your future.

Millennials are a confident generation, which is a good thing. Nearly 70% say they believe they will achieve a greater standard of living than their parents and will be able to save enough to live the lifestyle they hope to have in retirement. But in order for this to be reality, circumstances and spending habits will need to change.

What to do if your Adult Child Moves Home?

The Washington Post had a great article that covers a few suggestions of how to handle your child moving back home. Some of these suggestions include:

- Set a time limit.

- Charge rent.

- Don’t let your child get too comfortable.

- Be supportive.

Remember, There IS Help Out There!

Any time life throws you a curve ball that could affect you financially, and this relates to both the Millennials and their parents, you should consider consulting with a Certified Estate Planner! Whether it is the Millennial who has questions about their 401(k) plan, or the parent who now has an unexpected additional house guest and additional expenses, it is always the right choice to ask for assistance when managing your nest-egg. A Certified Estate Planner is someone who can best advise you on the different retirement products and options available to you, as well as recommend changes to your existing retirement plans to provision for the added financial strain you may face upon your child returning home. Your CEP will help you choose a retirement product that will best fit your needs now, in the future, and even provide for your loved ones in the event of your death. A CEP can help you choose an insured retirement option that safely works for you by earning income, while still providing beneficial tax breaks. A CEP will help you by ensuring that each of your retirement products are properly structured to provide you the income you need and expect, while still taking advantage of the best tax breaks and incentives available. Jean Ann Dorrell, a Certified Estate Planner herself, along with the qualified & experienced staff at Senior Financial Security, Inc., is available to discuss and advise you of your retirement options as well as answer any questions you may have. Contact Senior Financial Security, Inc. today to schedule an appointment to explore your retirement possibilities!